She is a known LIAR and the Left loves her, whats new. This was one of her pet projects. Great news here

In 1925, President Calvin Coolidge said that “government control cannot be divorced from political control.” That piece of his governing philosophy put Coolidge at odds with the progressives of his own day, who believed a neutral, technocratic government was not only possible but desirable.

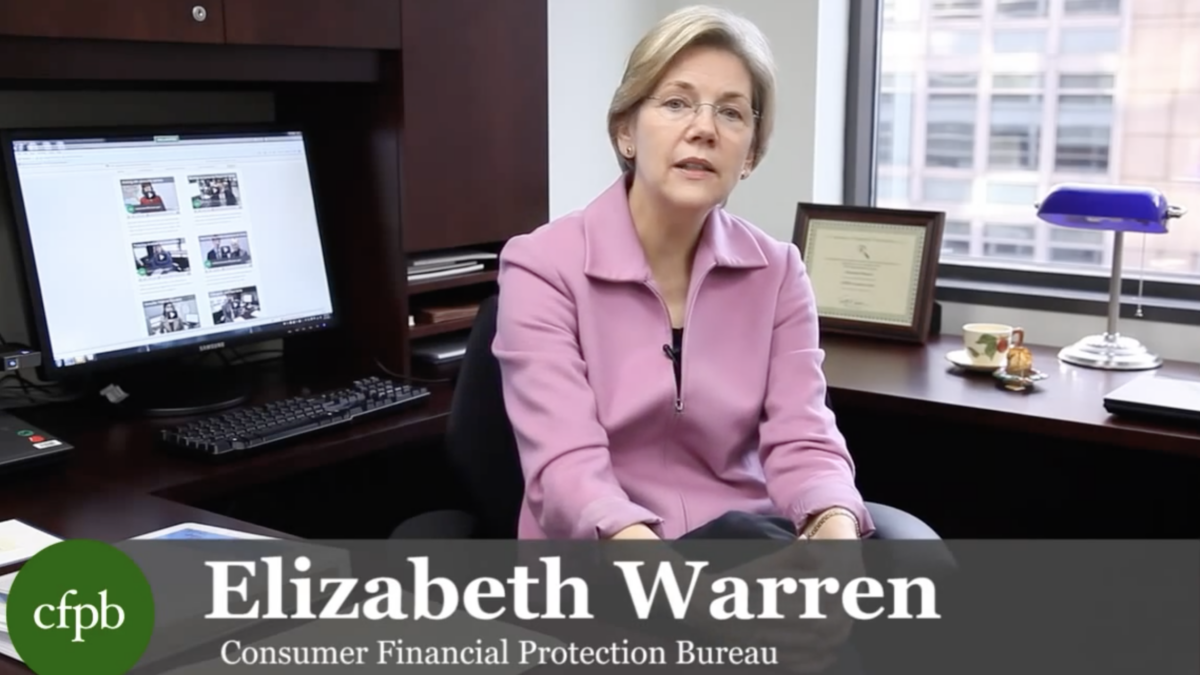

Their modern-day descendants have had their wish fulfilled, in part, through the Consumer Financial Protection Bureau (CFPB). Created under the Dodd-Frank Act of 2010 in response to the credit crisis of 2008-09, the agency was tasked with consumer protection in the nation’s financial sector. There were already a handful of agencies that did this, but what made the CFPB especially beloved on the left was that it was insulated from political pressure.

That is to say, it governed without answering to the people or their elected representatives in any serious way.

If that sounds disturbing to you, you’re not alone. Concerned citizens immediately challenged the part of the law that said the agency’s head could not be removed by the president except “for cause,” an unusual level of unaccountability in a republic. In 2020, the Supreme Court agreed, holding in Seila Law LLC v. CFPB that Congress could not limit the president’s power to appoint and dismiss executive branch officials.

The CFPB is at odds with our republican form of government in another way, which came to the forefront in a Fifth Circuit Court of Appeals decision this week in Community Financial Services Association of America v. CFPB: the bureau receives its funding directly from the Federal Reserve, bypassing Congress’s power of the purse.

As Judge Cory Wilson noted in the Oct. 19 opinion (quoting Seila Law,) “Each year, the Bureau simply requests an amount determined by the director to be reasonably necessary to carry out the agency’s functions. The Federal Reserve must then transfer that amount so long as it does not exceed 12 percent of the Federal Reserve’s total operating expenses.” (internal quotes and citations omitted).

The left’s dream agency — and the vision of its most prominent advocate, Elizabeth Warren — was designed to have a director who could not be fired and a budget that could not be cut. Whatever other excesses the administrative state had reached before this, they at least were ultimately accountable to the president in the leadership and to Congress in their budget. Warren and the progressives designed the CFPB to avoid even those notional controls, creating what critics rightly called a “fourth branch” of American government.

The funding mechanism was one of several objections the plaintiffs raised in the case, and the court agreed that it was unconstitutional, violating the Appropriations Clause of Article I, which holds that “No money shall be drawn from the Treasury, but in Consequence of Appropriations made by Law”.

Quoting from James Madison’s explanation of the spending power in “Federalist No. 48,” the court notes that “the legislative department alone has access to the pockets of the people.” Historically, this made Congress the most powerful of the three branches. In the days since Madison, Congress has steadily acquiesced in the erosion of its other powers, leaving the executive branch the power to define law through the administrative state, and turning to the courts to fix things rather than writing new laws. But Dodd-Frank and the CFPB mark a unique departure from our frame of government as Congress gave away even that one remaining power, the ability to determine an agency’s budget.

This novel funding scheme, as the court says, “is literally off the books.” Unaccountable, unfireable, and thoroughly undemocratic, the bureau is the pinnacle of progressive government.

In striking down the regulation at issue in the case, the court declined to state what the longer-term effects of their ruling would be. The agency and its employees will continue their work for now. Appeals will certainly follow, certainly to the whole Fifth Circuit en banc, likely to the Supreme Court after that. At the very least, the funding structure of the CFPB could be struck down, making the agency financially responsible to Congress once more, like every other part of the government — an important consideration as Republicans stand a good chance of electing congressional majorities next month. But, though it is somewhat unlikely, the courts could find the funding system to be not “severable” from the rest of the section of the Dodd-Frank Act creating the CFPB, casting the whole agency’s existence into doubt.

For all the talk of our democracy being under attack, Warren and other congressional Democrats seem desperate to insulate their pet programs from the voters in our democratic republic. They started a new agency, packed it with their own people, and then declared that it was off-limits to future Congresses.

Unfortunately for them — and fortunately for the rest of us — the courts have recognized that this is not how republican self-governance works. First in Seila Law in 2020 and now in Community Financial Services, courts have seen the CFPB for what it is: an unaccountable power grab that takes government away from the people and places it in the hands of a self-perpetuating elite. Government control is political control, as Coolidge said — and the people must be allowed to change out the politicians from time to time.

https://thefederalist.com/2022/10/24/court-ruling-on-federal-financial-watchdog-is-another-blow-for-unelected-unconstitutional-bureaucratic-agencies/

https://thefederalist.com/videos/hemingway-democrats-are-wrong-to-push-abortion-as-inflation-fix/

https://thefederalist.com/videos/hemingway-democrats-are-wrong-to-push-abortion-as-inflation-fix/

No comments:

Post a Comment