Three facts prove that sensible spending coupled with pro-growth reforms is the solution to the current crisis.

1. Illinois has a spending problem. Not a revenue problem.

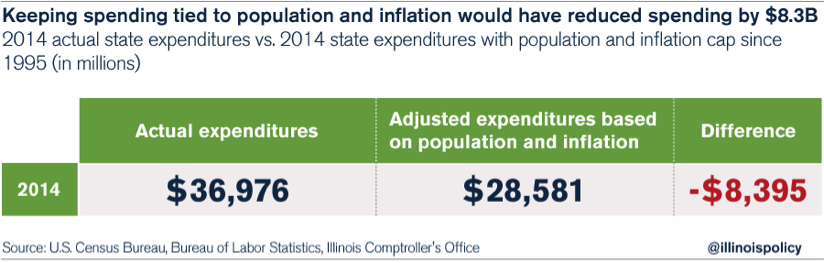

If Illinois spending had grown at the same rate as inflation and Illinois’ population, the state’s expenditures would have been $8 billion less than they were in 2014.

Extending this analysis to today reveals Illinois would be looking at approximately $30 billion in expenditures for fiscal year 2016 – which would be more than covered by this fiscal year’s expected $32 billion in revenues.

2. Bad policies led to out-migration – which made the budget crisis worse.

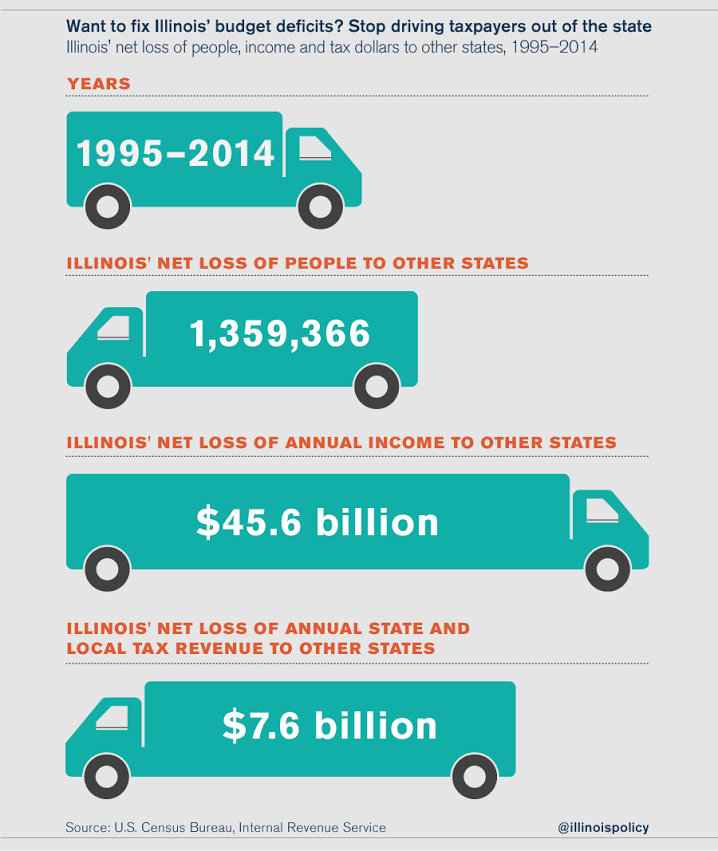

Illinois’ massive out-migration under Madigan’s tenure has cost the state dearly. In the last two decades alone, Illinois has lost 1.4 million more people to other states than it has gained from those states, according to the U.S. Census Bureau. This net exodus of Illinoisans has resulted in a crushing loss of $45.6 billion of annual adjusted gross income and $7.6 billion in annual state and local tax revenue, which would be divided about evenly between state and local coffers.

By investing in pro-growth policies years ago instead of keeping the crony, corrupt and anti-taxpayer status quo, there would be billions of dollars in additional revenue with which to balance the budget today.

3. A look at the last four years shows that more taxes isn’t the solution to the state’s crisis. In fact, higher taxes made things worse.

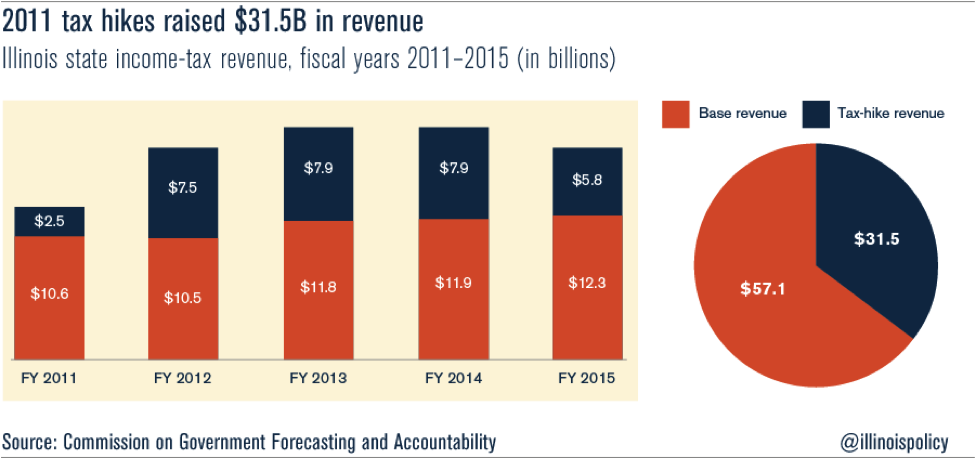

In 2011, Illinois increased its personal income tax by 67 percent and its corporate income tax by 46 percent, raising $31.5 billion in additional revenue from 2011-2014.

But Illinois didn’t spend those additional billions on education, health care or human services. Instead, according to Senate President John Cullerton, the state used about 90 percent of the tax-hike revenue to pay into the state’s pensions systems and pension obligation bond payments.

So nearly 90 cents of every tax-hike dollar went to pay for pensions. Despite that, the state’s unfunded pension liability still rose by a third, or $28 billion, while the tax hike was in place. On top of the out-migration crisis that ensued, Illinois and Chicago’s credit ratings received several downgrades from multiple rating agencies.

There is a lesson to be learned from all this. If Illinoisans fill Springfield’s coffers with new money, politicians won’t enact any reforms. They’ll simply spend it and be back again soon, asking for another tax increase.

Instead, Illinois needs a budget and pro-job policies that create prolonged and sustainable economic growth – not a government that borrows, taxes and spends itself into a new crisis every few years.

http://www.zerohedge.com/news/2015-09-21/mystery-missing-inflation-solved-and-why-us-housing-crisis-about-get-much-worse

No comments:

Post a Comment