She kind of dampened the narrative on the Left when they all blamed Trump on the Banks issue.

Then the link below is of that IDIOT Warren blaming Fed chair for economic problems.

Clue; its also Biden and his band of Idiots policy failures but she dont mention that. she voted yes on the tax hikes and spending. She is also to blame

Treasury Secretary Janet Yellen on Thursday testified before the Senate Finance Committee on Biden’s 2024 budget proposal.

Yellen was also grilled about Silicon Valley Bank’s failure.

Silicon Valley Bank shuttered last Friday after it was unable to produce enough cash for depositors.

Senate Finance Committee Ranking Member Mike Crapo (R-ID) got Janet Yellen to admit Biden’s inflation crisis led to rapid rate hikes which then led to the banking crisis.

Senator Crapo said SVB’s capital was losing value and they were not able to access their capital because of the Federal Reserve Chairman’s decision to rapidly hike rates in 2022.

Yellen admitted Biden’s inflation crisis ultimately led to the banking crisis.

“My understanding is that the bank, to meet liquidity needs had to sell assets that it expected to hold to maturity and given that the interest rate increases that have occurred since those assets, including treasuries – and government-backed – mortgage-backed securities they had lost market value,” Yellen said.

WATCH:

A story in three parts:

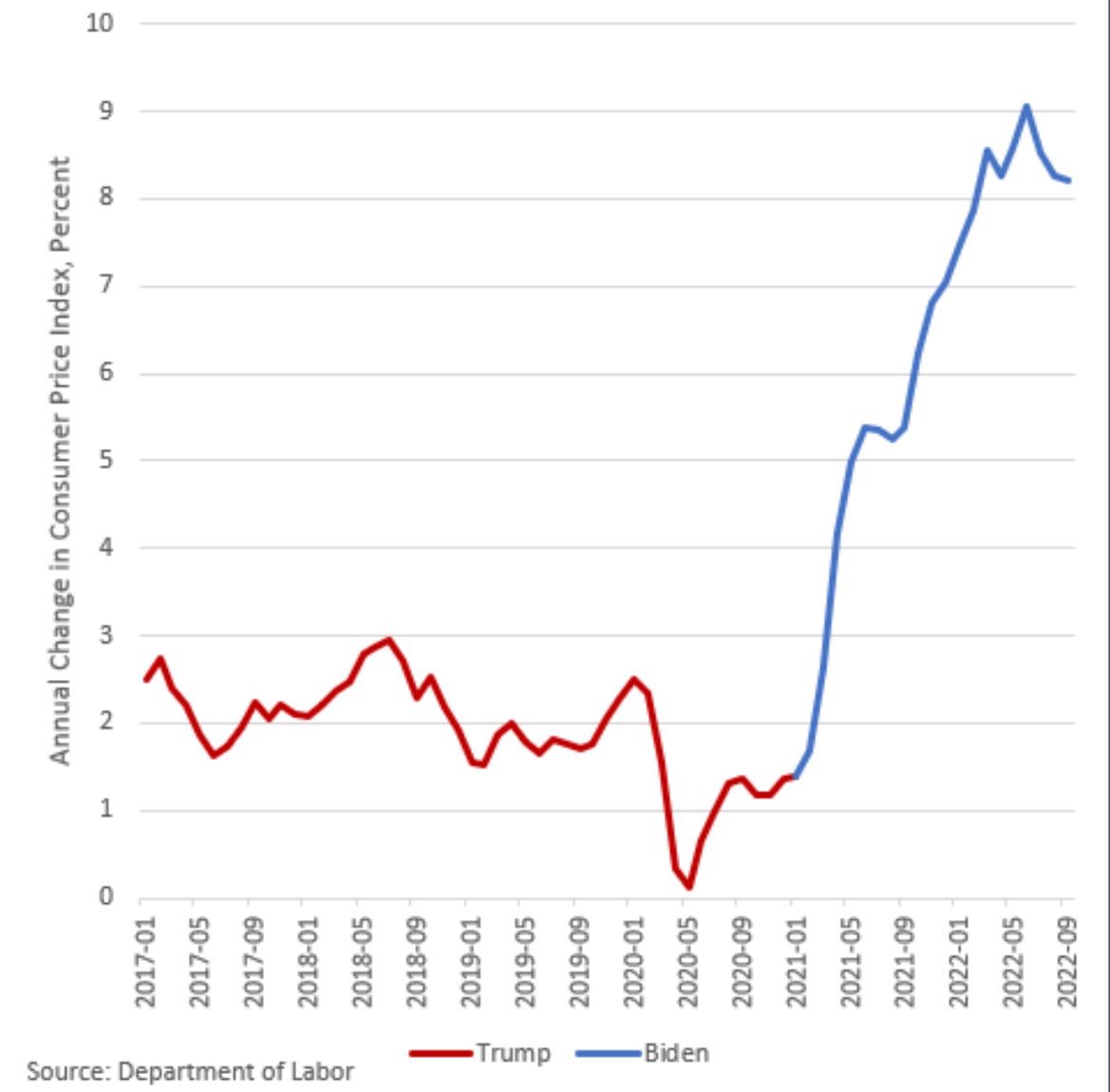

Joe Biden and Democrats in Congress created the inflation crisis by spending more than $6 trillion in a couple years.

Inflation hit 40-year highs because of Joe Biden.

Enter the Federal Reserve…

Federal Reserve Chairman Jerome Powell raised rates seven times in 2022 for a total of 450 basis points – or 4.5% to hedge inflation.

The sudden and dramatic rate hikes crushed Silicon Valley Bank.

Jerome Powell knew exactly what he was doing.

Silicon Valley Bank reportedly held $173 billion in deposits.

The Fed interest rate is at 4.57% and $117 billion of Silicon Valley Bank’s deposits were in mortgage-backed securities that were only yielding 1.56-1.66% – this caused a run on the bank.

By Friday Silicon Valley Bank was in FDIC receivership.

Every single SVB depositor was bailed out by the Biden Regime.

The question is, why didn’t the so-called bank regulators see that Silicon Valley Bank was a ticking time bomb?

https://www.thegatewaypundit.com/2023/03/janet-yellen-admits-joe-bidens-inflation-crisis-is-linked-to-the-banking-crisis-video/

https://www.breitbart.com/clips/2023/03/22/warren-calls-for-fed-chair-powells-ouster-he-is-trying-to-drive-u-s-into-recession/

https://www.thegatewaypundit.com/2023/03/jpmorgan-says-us-probably-headed-for-recession-amid-banking-crisis/

No comments:

Post a Comment