Here are the top 10 facts you need to know about Illinois’ pension crisis:

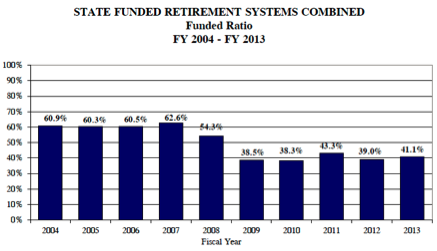

1) Illinois’ state pension funds have only 41 cents for every dollar they need to pay out future benefits.

2) Illinois has the nation’s worst pension crisis. Taxpayers are officially on the hook for more than$100 billion in unfunded Illinois pension debt, according to the state’s estimates.

According to Moody’s Investors Service, Illinois pension shortfall is closer to $200 billion based on more realistic investment assumptions.

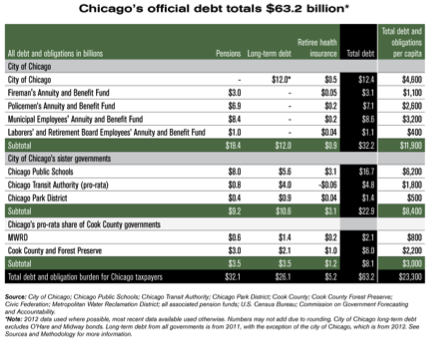

3)In addition to the state’s debt, Chicago taxpayers are on the hook for $63 billion in city debt, pension and healthcare liabilities. That’s $61,000 in debt for every Chicago household.

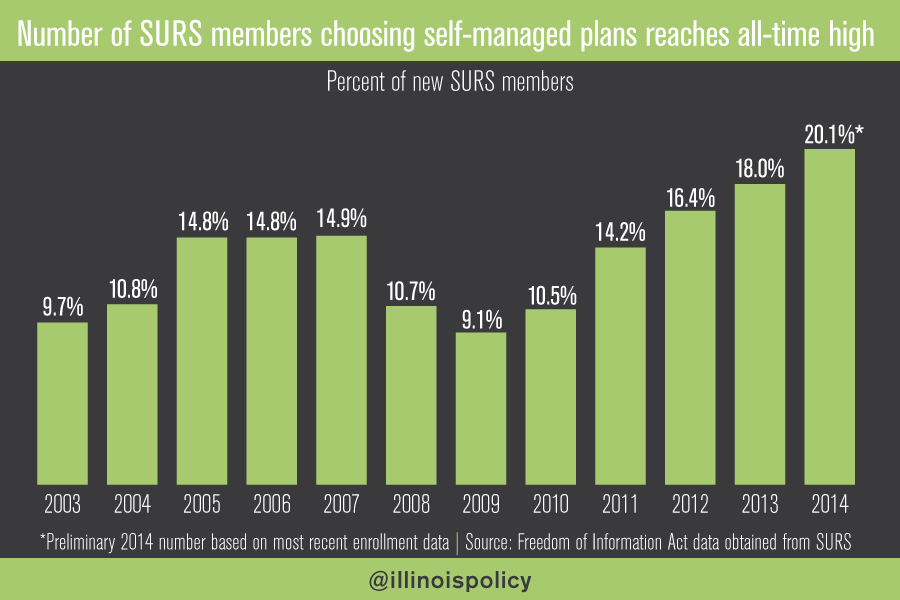

4) There is a group of government workers in Illinois who don’t have to worry about the political mismanagement of pensions: employees of state universities. That’s because they have control over their own retirement futures with 401(k)-style plans. Eighteen thousand members of the State Universities Retirement System, or SURS, have opted into the SURS 401(k)-style retirement plan. In 2014 alone, participation in the 401(k)-style plan for new members reached a record high of 20 percent.

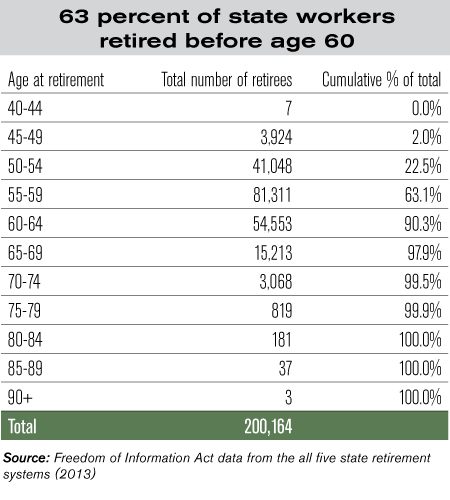

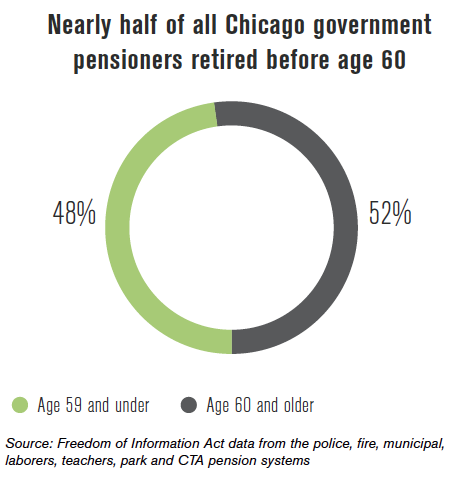

5) More than 63 percent of state pensioners and 49 percent of Chicago pensioners retired before the age of 60.

6) The average state retiree contributed only 6 percent of what they will receive in pension payouts. Average career teachers will contribute only about $100,000 to their pensions, yet will receive $1.5 million to $2.5 million over the course of their retirement, depending on the age at which they retire.

7) More than 8,000 government retirees who currently receive more than $100,000 in annual pension benefits also receive annual Cost of Living Adjustments, or COLAs. Reforming COLAs is the largest reform lever for reducing state and local unfunded pension liabilities.

8) The Illinois General Assembly passed Senate Bill 1 in 2013. The pension reform measure is currently being challenged in the courts. Even if the bill passes the courts in its entirety, it will only drop the unfunded liability to 2011 levels – levels that had already thrown Illinois into crisis. Bringing the pension funding levels back to the crisis levels of just a few years ago isn’t reform. And the remaining $80 billion pension shortfall will continue to cripple the state.

9) The Illinois Policy Institute’s pension reform plan protects already-earned pension benefits and transitions to 401(k)-style plans going forward. This plan ends the political mismanagement of pensions and gives workers control of their own retirement futures.

10) All of Illinois’ pension funds have released their comprehensive annual financial reports, or CAFRs, for 2013.

No comments:

Post a Comment