Newly released data from the IRS reveal that in 2012, Illinois lost more taxpayers and taxpayer wealth to a greater number of states than ever before.

The Internal Revenue Service has released migration data that paint a grim picture of the flow of taxpayers and their income out of Illinois. In 2012, Illinois set worst-ever records for taxpayers and income leaving the state.

The following three facts outline the dismal picture IRS numbers painted.

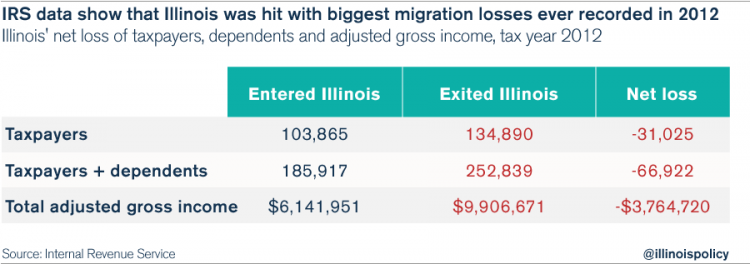

- In 2012, Illinois achieved all-time worst records for: Net loss of taxpayers plus dependents (66,922), and net loss of income ($3.8 billion).

In 2012, Illinois lost 66,922 taxpayers and dependents on net, along with $3.8 billion in adjusted gross income.

The 2012 IRS data came out just one month after the IRS released migration data for the 2011 tax year, the first year of Illinois’ historic income-tax hike. The 2012 numbers were the worst ever for the state. The 2011 migration data showed steep losses of taxpayers and income for Illinois, as well.

In 2011, IRS data indicated that Illinois lost 50,000 taxpayers plus dependents on net, with losses of people to every state in the Midwest for the first time ever. Illinois also lost an unprecedented $2.5 billion of adjusted gross income in 2011, the biggest loss of income prior to 2012, driven by the departure of higher-income earners.

- The taxpayer flight from Illinois accelerated in 2011 and 2012, especially in terms of income lost. Those who left Illinois in 2012 made a lot more money, on average, than those who moved into the state.

Those who left Illinois in 2012 had an average adjusted gross income of $73,400, an all-time high, compared to an average adjusted gross income of $59,100 for those who moved into Illinois. So not only did Illinois lose more taxpayers than it gained, but those who left Illinois earned 24 percent more than those who entered the state. Never before has the difference in average income between people leaving and people moving into Illinois been so wide.In 2012, Illinois set records for the highest average income of people leaving Illinois ($73,443) and the biggest gap between the average income of people who left and the average income of those who entered Illinois ($14,309).

- Illinois lost head-to-head migration battles with 46 out of 50 states, plus the District of Columbia, in tax year 2012, the worst-ever count of such losses for the state.

Illinois’ migration-contest losses included every single state in the Midwest, something that had never happened before 2011, according to data the IRS has been tracking since 1990. In the years prior to 2011, Illinois usually gained people from Rust Belt peers such as Michigan and Ohio, along with some people from North Dakota and South Dakota. That trend has reversed. In 2012, Illinois lost taxpayers and their dependents to every state in the Midwest for the second time since 2011, and to a record-setting 46 out of 50 states, plus the District of Columbia.

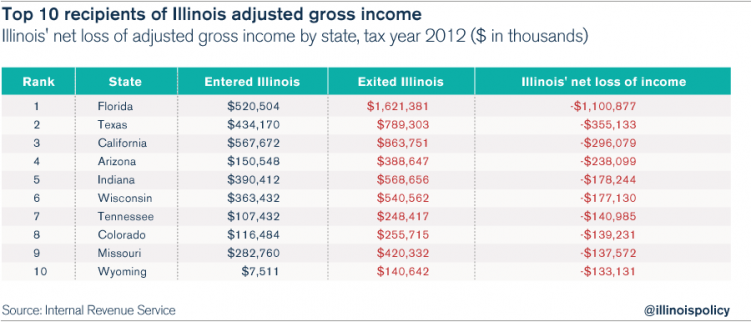

In 2012, for the sixth year in a row, Texas gained the most Illinoisans, taking in 10,500 people from Illinois on net. That represents the biggest migration gain the Lone Star State has ever made against Illinois. Other states receiving large numbers of Illinoisans include Florida, California and Arizona, as well as neighboring states such as Indiana, Wisconsin, Missouri and Iowa.

The loss of taxpayers and their dependents in 2012 mirrored Illinois’ loss of adjusted gross income to other states. In 2012, Illinois had a net loss of income to 41 out of 50 other jurisdictions. Florida led on this front, taking in a net $1.1 billion in adjusted gross income from Illinois in 2012, an all-time high for the Sunshine State. Florida’s previous largest gain of Illinois income was in 2011, when it took in a net of $717 million from the Land of Lincoln.

The IRS migration data show the folly of income-tax hikes and of Illinois’ anti-growth policies

The IRS data reveal the foresight of those who warned against Illinois’ 2011 tax hikes. The 2011 and 2012 migration data show how quickly Illinois can lose taxpayers and their income to other states. Even though Illinois has followed a yearslong trend of losing residents to other states, the level of out-migration clearly accelerated in the wake of the 2011 income-tax hikes, especially among higher-income Illinoisans.

Taxpayers and businesses move to the most advantageous and hospitable locales. The new IRS data make it perfectly clear that Illinois’ legislative leaders, led by House Speaker Mike Madigan and Senate President John Cullerton, are driving taxpayers and businesses away. In 2012, for the second year in a row, taxpayers chose every other state in the region over the turf controlled by Illinois’ leaders in the General Assembly.

The data substantiate Gov. Bruce Rauner’s argument that simply raising taxes again would be a disaster for the state and should only be considered in the context of carrying out the fundamental reforms necessary for the state to grow its economy. The governor has set forth five clear legislative reforms to turn around the ship of state and chart a course away from the economic and fiscal peril that lies ahead. Given the extraordinary loss of taxpayers and income that resulted from the 2011 tax hike, Rauner’s efforts to direct Illinois away from another such debacle deserve support.

Note: IRS migration data should not be confused with U.S. Census Bureau migration data. The IRS data are an important input for the Census Bureau’s data, but the census data usually show larger changes in the number of people moving. This is because IRS data capture only taxpayers and their dependents, while the Census Bureau also estimates the movement of people who do not file taxes, such as new college graduates.

No comments:

Post a Comment