Proposed legislation before the Illinois Senate would implement a penny-per-ounce soda tax as a way to reduce soda consumption and raise even more state revenue. The tax would hit sugary drinks sold in containers, including regular sodas, fruit drinks, sports drinks, energy drinks, and tea and coffee drinks.

Targeting an industry and its consumers does not make for sound public policy.

Neither does the fact that the tax would fall disproportionately upon minorities and the poor. The reverse-Robin Hood nature of the legislation should be indicated as a note to the bill.

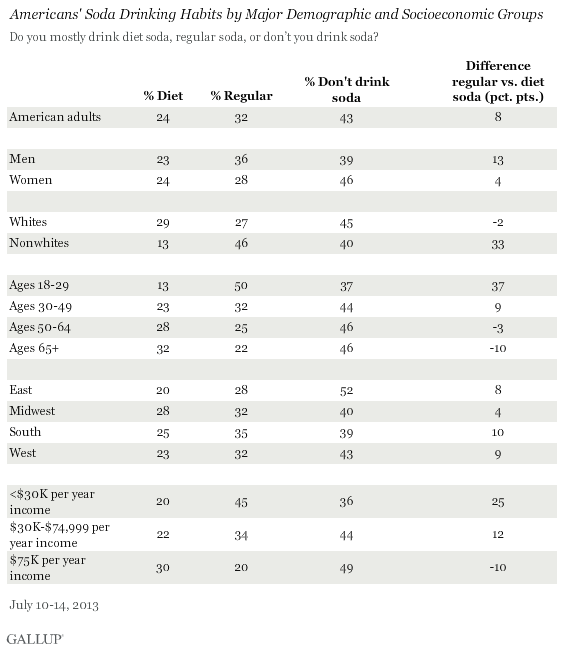

A Gallup poll conducted in July 2013 shows that a higher percentage of nonwhites drink soda than do whites. The proposed soda tax targets “regular” soda rather than diet, which makes the tax even more targeted on minority groups. Nearly half of nonwhites drink regular soda, versus about a quarter of whites.

More strikingly, 45 percent of people with incomes of less than $30,000 drink regular soda, while one-third of those with incomes from $30,000-$74,999 drink regular soda. Only one-fifth of those with incomes of more than $75,000 drink regular soda.

A soda tax would fall upon those who can afford it least, and would serve only as another tax hike “solution” for a state that has a spending problem. Furthermore, state tobacco taxes have shown that “sin taxes” are inconsistent sources of revenue. A state cigarette tax that was projected to raise $350 million in annual tax revenue missed the mark by $130 million, leaving taxpayers on the hook for the difference.

Experience has taught us that targeted taxation creates jobs in the black market for the products involved. The infrastructure for this underground industry is already in place, as cigarette taxes have created a black market for cigarettes in Illinois. Reduced Pepsi and Gatorade sales in Illinois would be partially offset by increased sales, and tax revenue, in Indiana and Wisconsin.

http://illinoispolicy.org/illinois-soda-tax-would-hit-poor-and-minorities-hardest/?utm_campaign=Wildfire+Message+-+The+proposed+%22soda+tax%22+would+add+%242.88+to+the...&utm_content=po_894162&utm_medium=Social&utm_source=Facebook

No comments:

Post a Comment