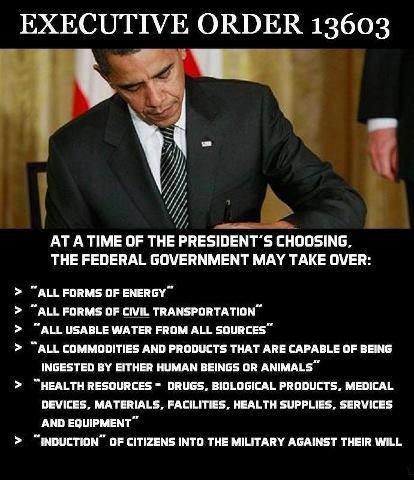

Do you know that on March 16, 2012, President Obama signed Executive Order 13603? What does that entail? Well, according to http://theonlyplaceleft.com, this order permits the U.S. government to officially take possession of any such thing from its citizens which it believes is crucial for protecting the security of U.S. For the same, if the need arises, martial law can also be executed by the government and private property rights can be abolished! Accordingly, even the rights that Americans were granted under their Constitution and their Charter of Rights are at stake!

Does this not look quite daunting? With 15% of the American population on some form of food stamps and 14% being the real unemployment rate, (including those having given up searching for jobs and those that want full-time work, but have to be content with only part-time ones) and many other problems -like 50% of the retired U.S. citizens having no more than financial assets worth $10,000, -like the statistics of the U.S. Census Bureau, which reveals that 25% of the U.S. residents (excluding Social Security) is presently living below the poverty line and the fact that this number is a 50-year high, the easy money creation by the Federal Reserve for restoring some sort of semblance to the American economy will certainly have worrisome effects in the long run.

There has been an alarming increase in welfare spending by 41% after the Obama administration began its reign. For the payment of its bills, bond issuance is being done by the government.

In the past, the U.S. treasuries would be bought by European nations and also by Japan and China. With the money received, the funding operations would be taken care of. But the current scenario paints a sorry state of economic affairs persisting in these countries. So how does the U.S. government confront this situation? Well, paper money is created out of nothing and this is used by the Federal Reserve to pay the treasury bills of the government! In this manner, in the year 2012, the Fed relieved the U.S. government of 61% of the Treasuries that it issued (Source: Wall Street Journal). If the government needs money, the Fed prints it. This is a cause for the devaluation of the U.S. dollar and this ‘Ponzi Scheme’ is bound to crash one day. At that time, the money can no more be printed. Austerity measures may not work as cutting the entitlements of the innumerable poor citizens may lead to civil conflicts.

The next most obvious step that the government could resort to would be to take its people’s money. With history having witnessed the seizure of its citizens’ private assets by the American government, it will not be very difficult for the latter to access the common man’s investments. After all, had notPresident Roosevelt declared the owning of gold above $100 by any private citizens to be against the law under Executive Order 6102 after which, not even two months were given for them to turn in all their gold to the Fed, for which they received a paltry amount of $20.67 per ounce?

According to http://theonlyplaceleft.com, America is heading towards an awful scenario; one wherein millions of U.S. citizens will become broke, all thanks to the tapping of their saved money by the American government!

National debt of the U.S. is presently to the tune of $17 trillion. There is also the burden of $123 trillion in unfunded liabilities for Social Security, Medicaid, and other entitlement programs, which makes the total debt a mammoth $140 trillion! This corresponds to a per-citizen debt of above $393,000.

Currently, with the U.S. dollar suffering devaluation, countries like Japan and China, which are ridden with their own problems are fighting shy of financing the debts of the U.S. So the fear that the American government can get to its citizens’ money deepens.

Under such circumstances, “How to protect and grow your money” is what the site http://theonlyplaceleft.com aims at. Widely recognized as predicting five major economic events over the past 10 years, it now reveals the reality of the magnitude of risk involved with the government probably aiming to nationalize retirement plans.

How can a portfolio be devised that will protect the interests of the U.S. citizens, without the government intervening by way of reaching out for their money?

No comments:

Post a Comment